‘Coinbase’, America’s first cryptocurrency exchange, made its debut on Nasdaq on the 14th. Global interest in cryptocurrency continues to grow along with expectations of its infiltration of the traditional financial market. Korea is also getting caught up in the hype of this hot trend.

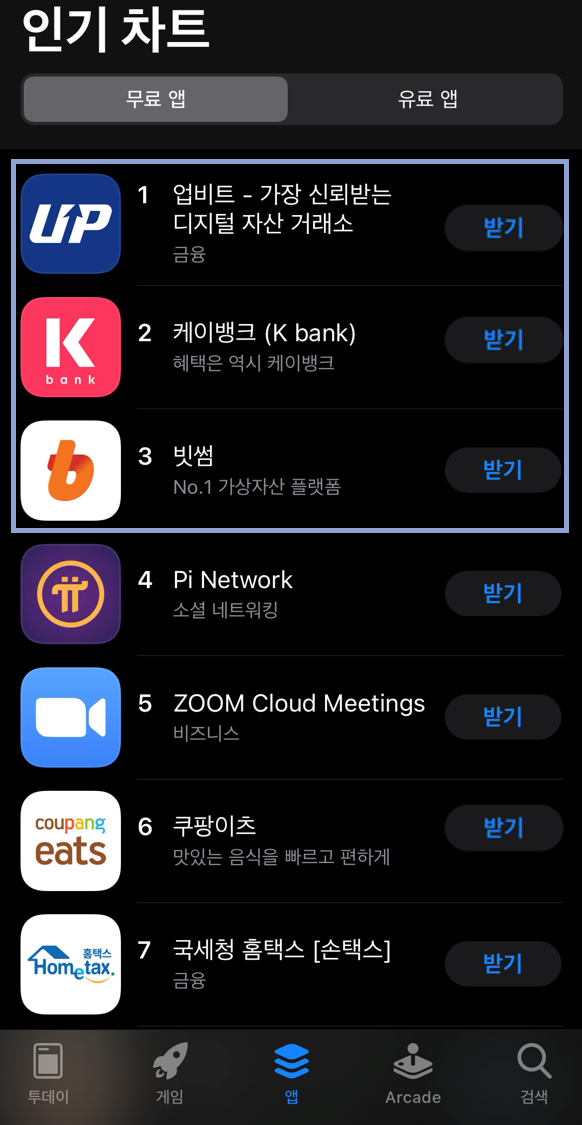

The iOS free app ranking chart published on April 22nd showed that cryptocurrency exchanges ranked top, with ‘Upbit’ in first place and ‘Bithumb’ ranking third. The internet-primary bank ‘Cake’, which formed a partnership with ‘Upbit’ in late June last year, saw the assets of its joint account with Upbit soar as the popularity of cryptocurrency investment continues to grow.

The iOS free app ranking chart, dated April 22nd, demonstrating the Cryptocurrency investment frenzy.

According to the first quarter global smartphone market settlement data released by App Annie, a mobile data and analysis platform, ‘Upbit’ showed the highest growth from one quarter to the next – further confirmation of the popularity of cryptocurrency.

Recently entering the spotlight in connection with this rising interest in cryptocurrency is the topic of NFTs.

What is an NFT?

NFTs are certified assets representing collectible items such as digital artworks which can be exchanged via blockchain. They are unique, non-exchangeable (‘non-fungible’) data that assign value to a digital media asset on the blockchain. NFTs can be tied to all kinds of digital assets including digital art, text-based documents, videos, photos, songs and codes.

The NFT is not a new concept. One example of an original NFT is the Ethereum-based digital trading game CryptoKitties which consists of buying and selling digital cats stored on the blockchain.

Why, then, are NFTs suddenly gaining attention?

According to the ‘Art Market Report 2021’ released by ‘Art Basel’, the world’s biggest art fair staged annually in Switzerland, and its financial sponsor, investment banking company UBS, Generation Y collectors were the highest spenders in 2020. There has been an increase in the rate of artwork collection by young people aged 20-40 following the popularization of the art market, particularly as online art market platforms have flourished since the breakout of the covid pandemic. The volume of global online art market exchanges rose to 12.4 billion dollars in 2020, double the value of exchanges made in 2019.

There are two recent events that have significantly elevated interest in NFTs along with the popularization of the online art market, increased interest in digital assets and increased enthusiasm for buying and collecting:

- Digital artist Beeple sold a digital artwork titled ‘Everydays: The First 5,000 Days’, for a record-breaking $69 million at Christie’s, a global artwork auction house.

- The NBA launched a trading card market called ‘NBAs Top Shots’ where fans can buy and sell live cards containing video highlights, such as spectacular dunk shots, in the form of digital tokens.

With the value of the NFT market soaring to more than $3 billion in conjunction with these events, there has also been rising criticism of the hype around NFTs due to the following concerns:

- The seemingly arbitrary valuation of NFTs is often unclear, highly unreliable and can even be meaningless or worthless.

- NFT value is heavily influenced by social media concepts of reputation.

- The underlying asset can be changed, deleted or moved after the NFT sale, depending on the NFT construction rules.

- Purchasing an NFT does not automatically mean gaining ownership of the underlying asset.

However, NFTs aren’t just speculative assets but can be important driving factors behind the production of digital items.

Through NFTs, organizations can build new business models, increase the value of existing products and services and enter new markets. Additionally, NFTs could create a new digital asset system that improves funding as well as generating revenue through secondary trading and increase the value and tradability of digital products and physical assets. With the growing importance of data-based personalization, businesses could create new customer-participation models by improving how they reach and segment their customers.

In order to best utilize the opportunities provided by NFTs while also protecting one’s business from related risk factors, the following should be considered:

- As the introduction of NFTs will lead to the restructuring of industries, products and processes, businesses should analyze the ecosystem connected to their business model or potential secondary ecosystems with good understanding of how market value flows through their customers and business partners.

- NFTs are removing the need for an intermediary between seller and buyer. NFTs will newly define royalty rates and clarify how value flows through intermediaries, which will subsequently have impact on existing margins and revenue flows.

- New funding, payment mechanisms and custody services need to be considered. The blockchain technologies that enable NFT adoption need to be further tested and new P2P tradable assets should be provided for the sake of helping to accelerate the decentralization of finance (DeFi).

- Higher value data assets can be created through NFTs. In this era where data is an asset, all businesses can participate in creating data markets.

BLOCKO XYZ, which is currently operating the digital content business card service CCCV, is also planning to launch the use of NFTs.

As CCCV is used by many content creators such as teachers, models, writers and photographers, BLOCKO XYZ aims to help them with securing clear ownership and selling their content.

BLOCKO XYZ also offers a solution to the high cost of NFT issuance due to Ethereum’s high gas fees through its Aergo Merkle Bridge. Through this technology, users can create an NFT without having to worry about gas fees.